msg insur:it

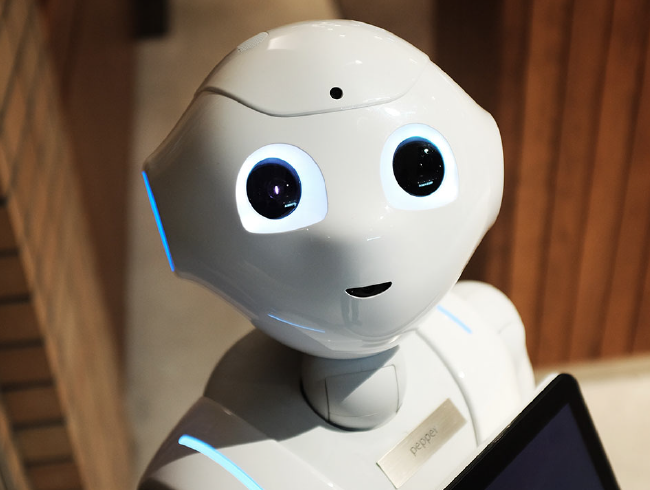

The Future of Insurance

msg insur:it stands for the most comprehensive range of solutions for insurers from a single source: two leading providers of IT insurance solutions, msg life and msg nexinsure, are pooling their strengths and unique know-how as a new co-brand.

With best-in-class standard software solutions, around 150 successfully completed large-scale projects, and over 40 years of expertise, we are your trusted partner for digital transformation.

Cloud Solutions

Product centricity in P&C insurance

Regulations in private compulsory care insurance

Continuous Delivery

Current trends in life insurance

✖

✖